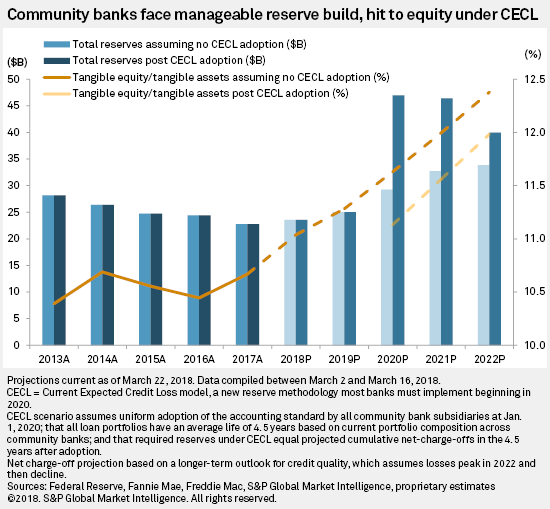

Cecl current expected credit loss is an accounting standard that requires us banking institutions to estimate life of loan losses at origination or purchase.

What does cecl stand for in banking.

What does cecl stand for.

Cecl replaces the current allowance for loan and lease losses alll accounting standard.

What does cecl stand for in banking.

The cecl network is an online space for aba members to come together share and learn the best ways to implement the current expected credit loss cecl standard.

Banking cecl abbreviation meaning defined here.

Cecl stands for current expected credit losses it s the new methodology for estimating allowances for credit losses issued by the financial accounting standards board fasb.

List of 24 cecl definitions.

The financial services industry is heralding the current expected credit loss standard cecl as the biggest accounting change in banking history as the financial accounting standards board s fasb accounting standard update cecl will affect all lenders and fundamentally change how institutions account for expected credit losses.

Previously companies could calculate their bad debt reserve based on years past.

Current expected credit losses cecl is a new credit loss accounting standard model that was issued by the financial accounting standards board on june 16 2016.

Get the top cecl abbreviation related to banking.